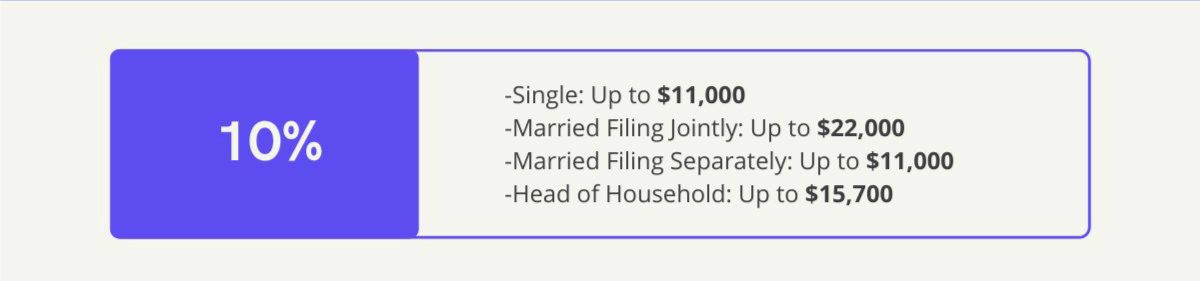

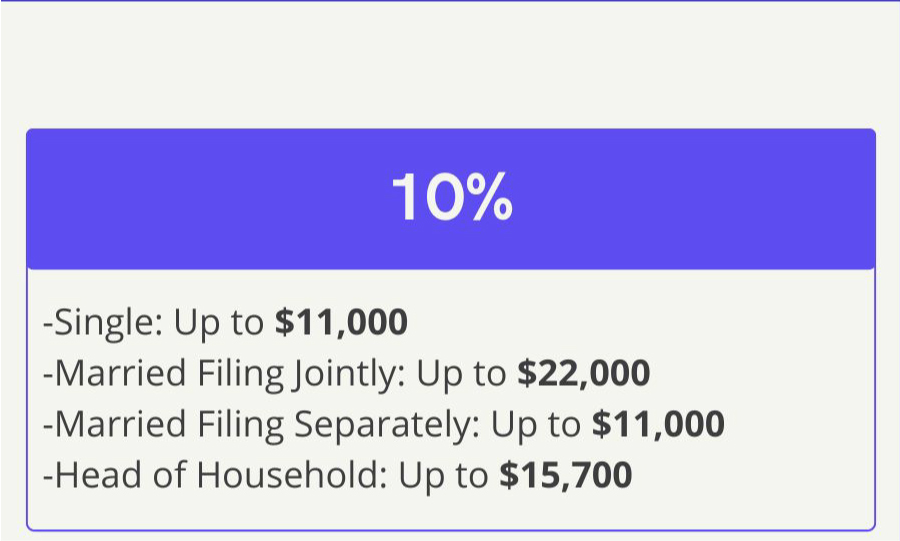

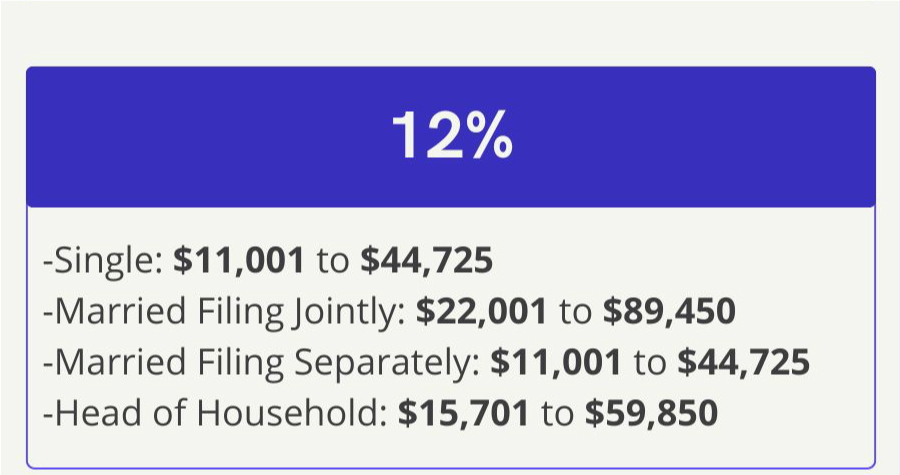

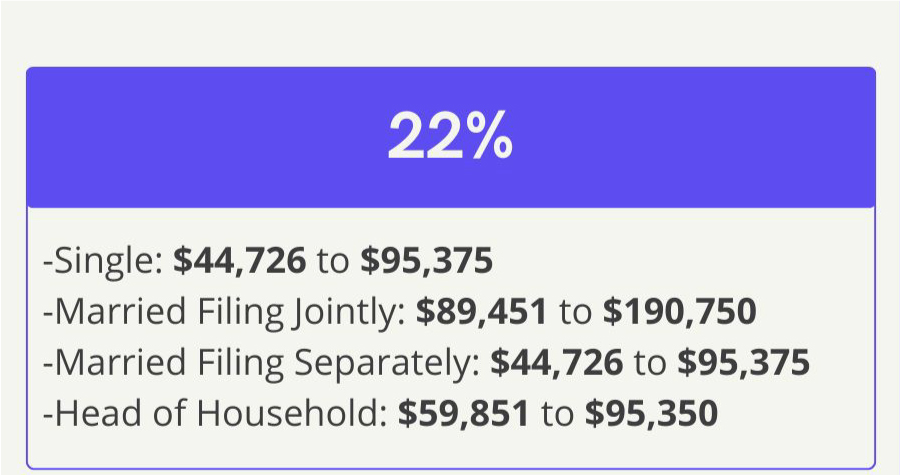

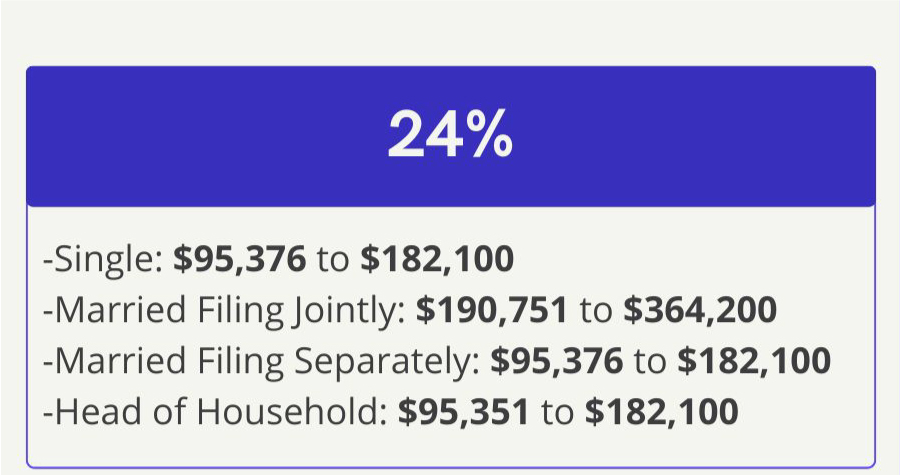

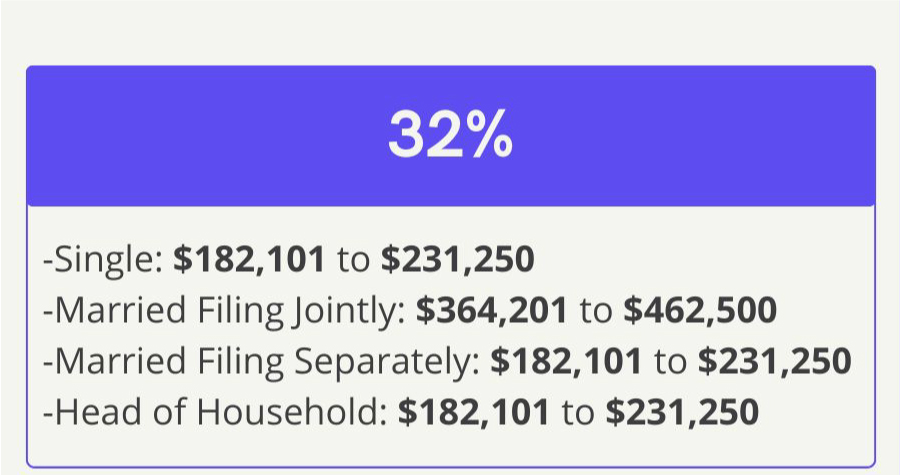

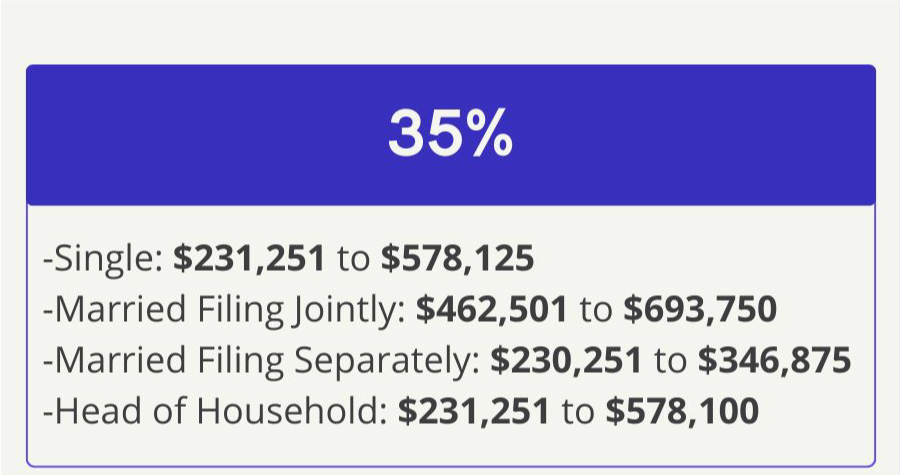

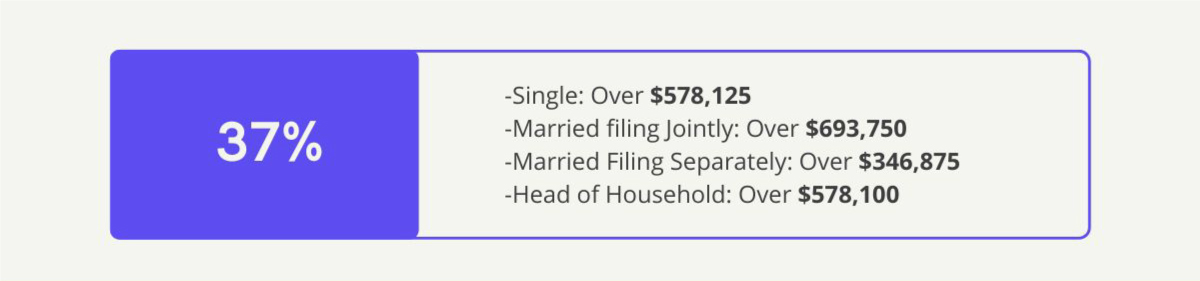

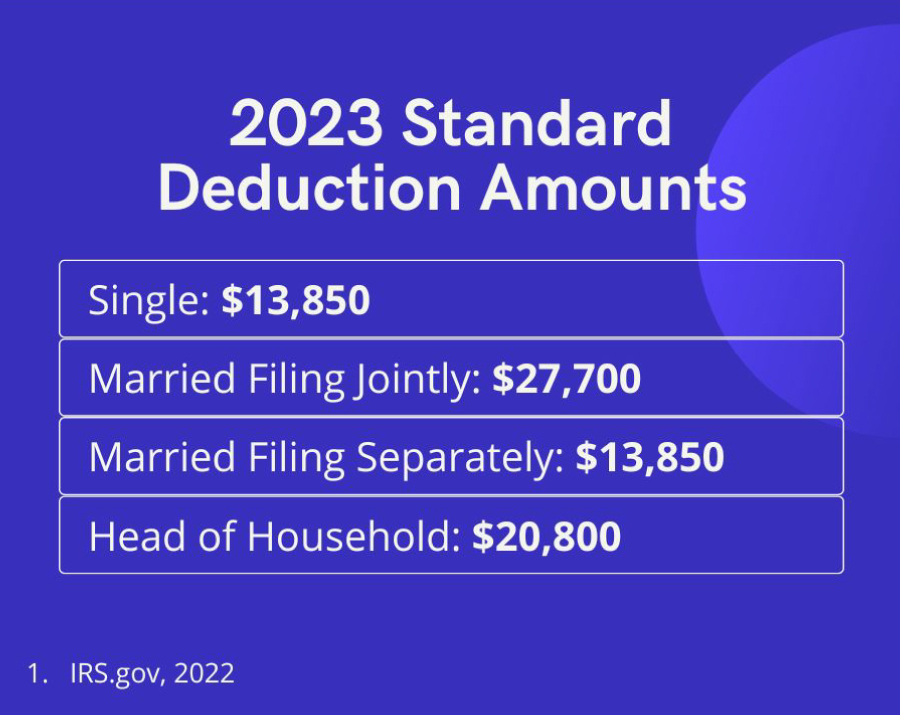

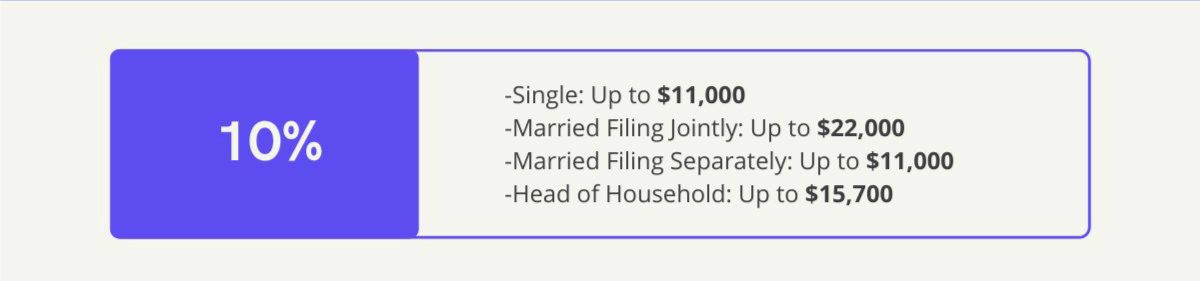

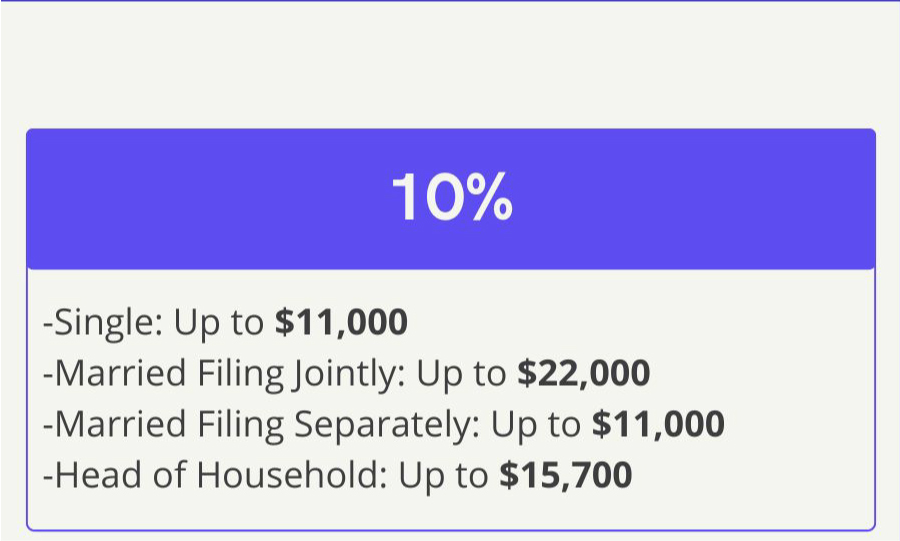

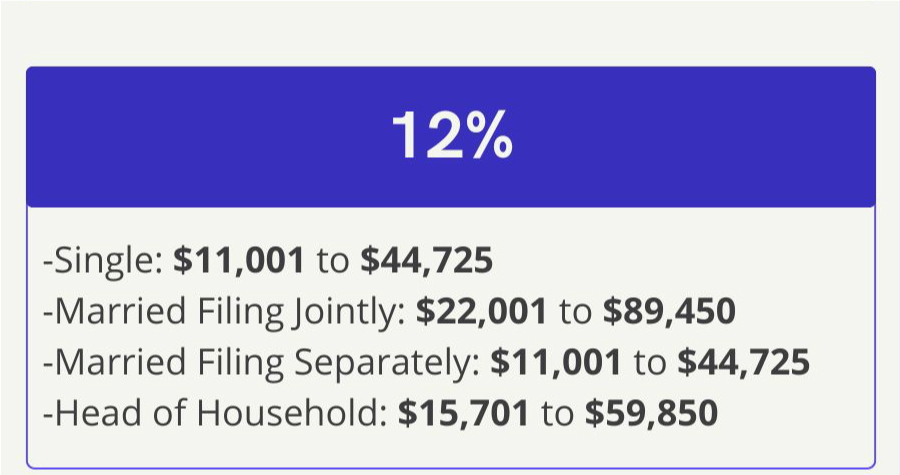

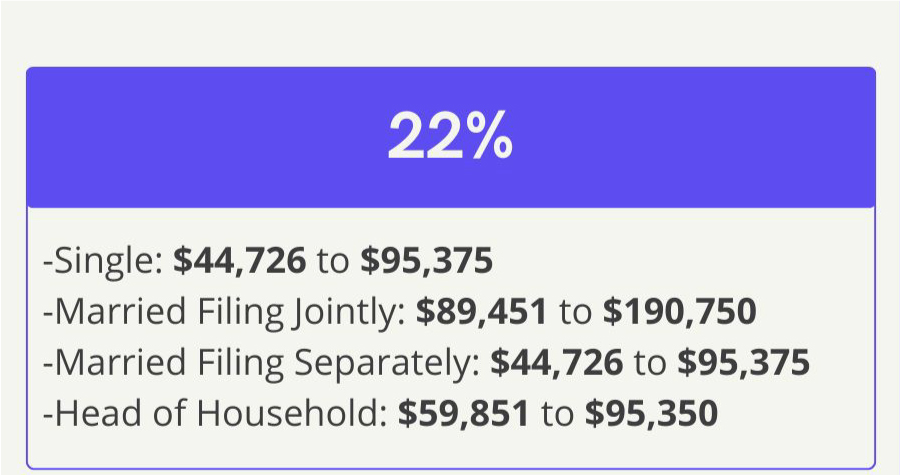

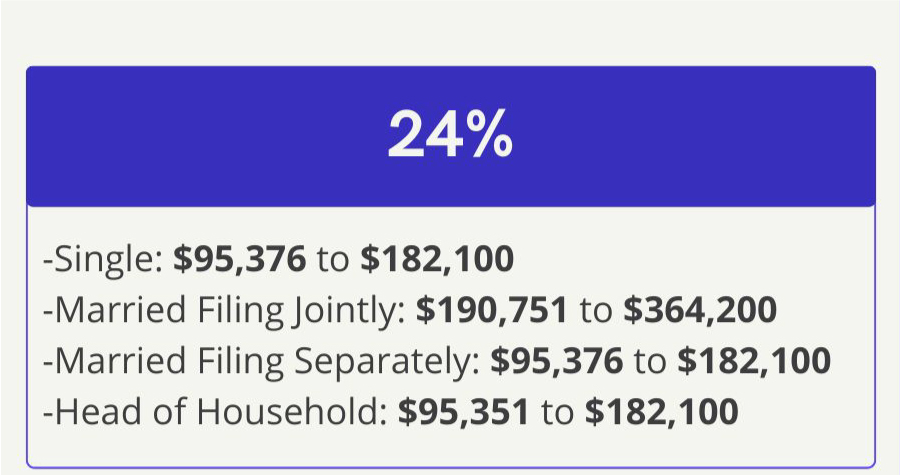

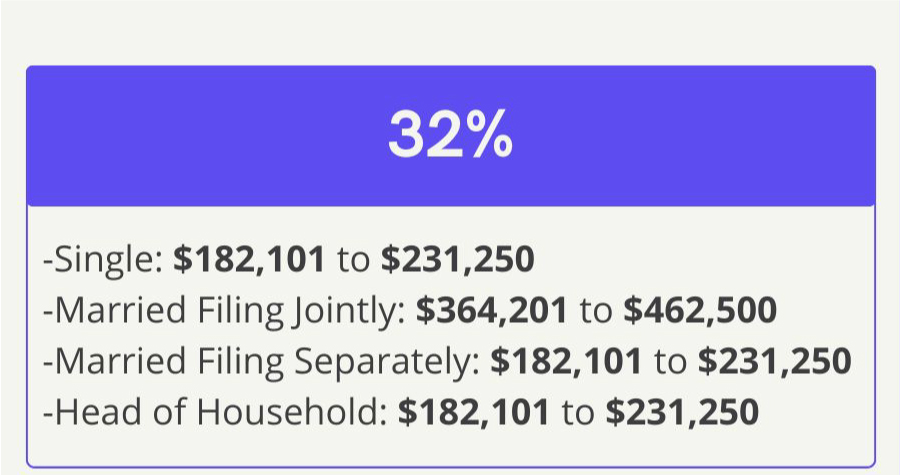

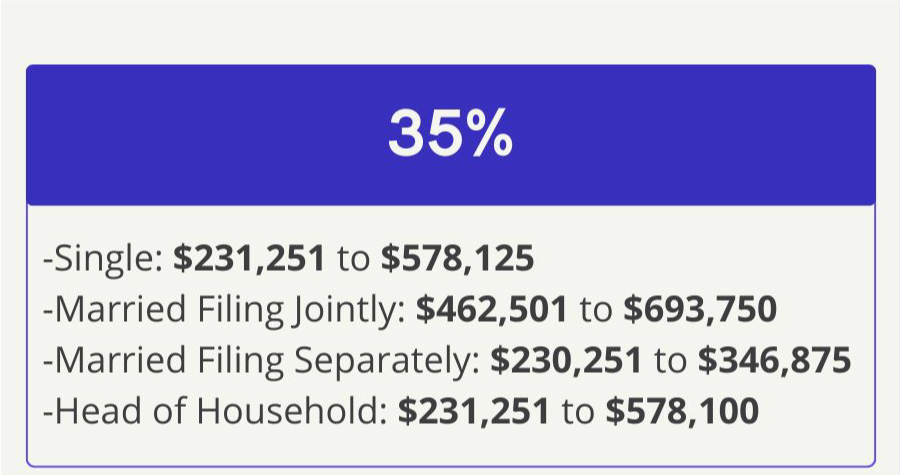

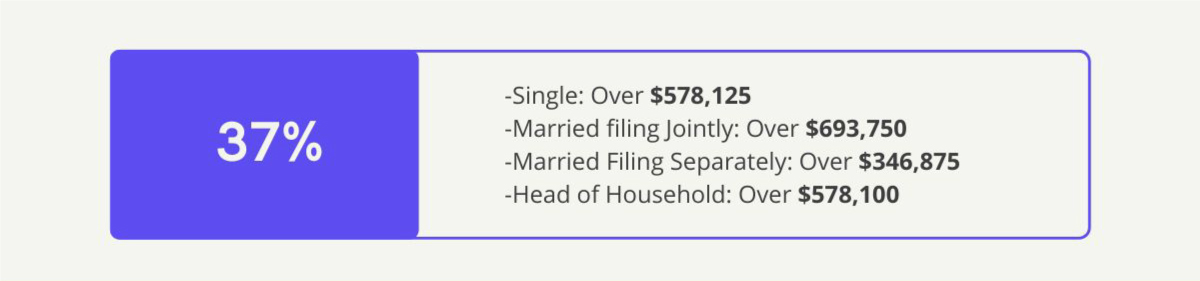

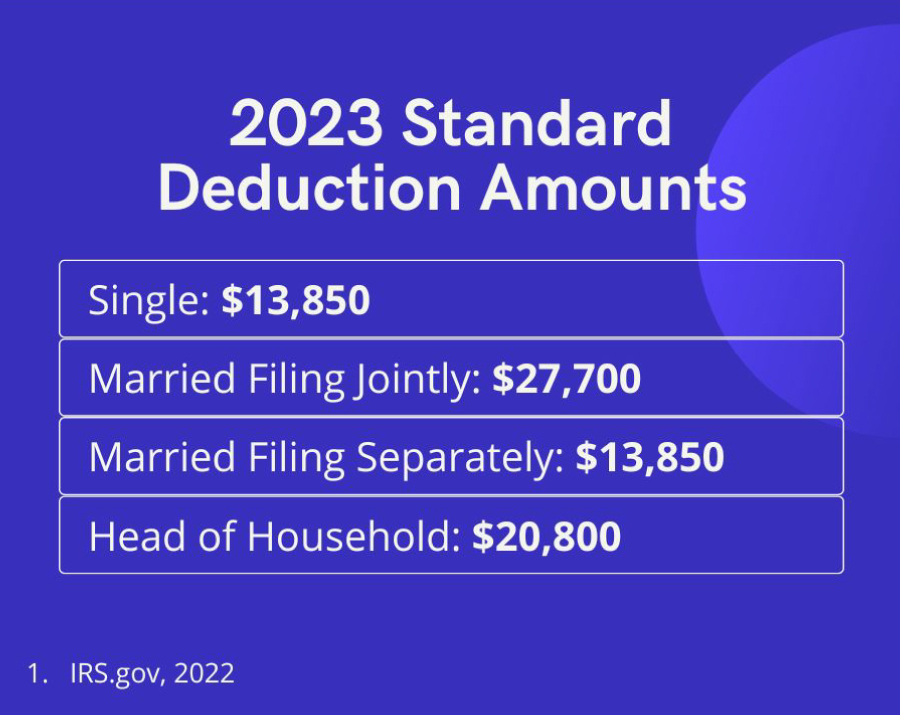

What's My 2023 Tax Bracket?

What do concerns or uncertainty about AI mean for your future and your financial strategy?

The federal estate tax exemption sunsets in 2025. Learn more about what to do to make the most of the higher threshold.

Bucket lists don’t have to be for tomorrow.

Are you a thrill seeker, or content to relax in the backyard? Use this flowchart to find out more about your risk tolerance.

Learn about all the parts of Medicare with this informative and enjoyable article.

There are benefits and limitations when you decide to donate stock.

Use this calculator to estimate your capital gains tax.

Use this calculator to compare the future value of investments with different tax consequences.

Assess how many days you'll work to pay your federal tax liability.

Here are 3 quick tips to keep in mind when buying or leasing your next vehicle.

This short video helps explain why markets can be as unpredictable as the weather.

Reviewing coverage options is just one thing responsible pet parents can do to help look out for their dogs.